The European Sponsorship Association (ESA) conducted its first Sponsorship Sentiment Tracker research in the first two weeks of April, with invites sent out to members/ non-members involved in sponsorship. More than 150 companies responded to our call to action, ranging from agencies, brands, rights holders, research companies and others.

ESA plans to send out its Sponsorship Sentiment Tracker at the end of every month to track the changes over time and share the data with the industry.

Below are the five key findings from the research.

Adapting is key

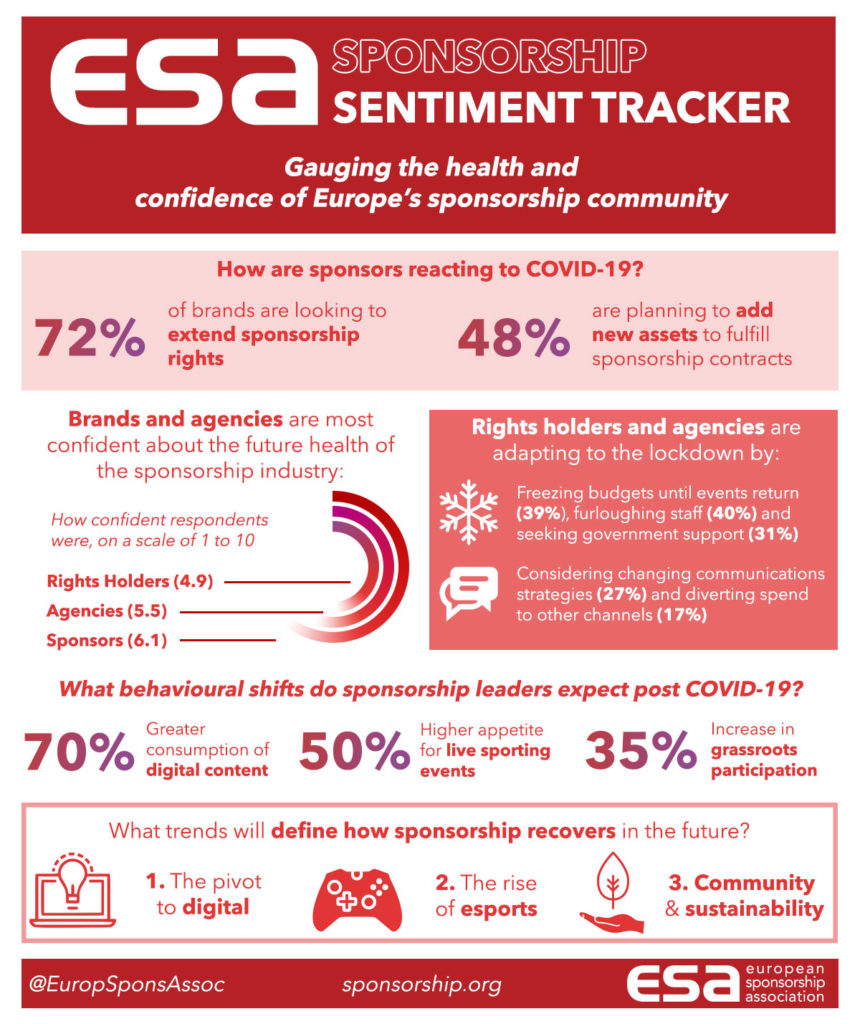

The sponsorship industry has (as well as other industries) had to learn to adapt to an ever-changing situation. Many in the industry (if not all) have frozen budgets (40% of respondents) and been forced to revisit their 2020 strategy, planning for a number of scenarios (67%), in light of the uncertainty ahead. Rights Holders are more likely to freeze budgets, whilst agencies tended to divert spends to other channels. Everyone wants to be able to be up and running as soon as lockdown is over, however not one, but several scenarios will need to be generated, as life will not go back to normal, but a ‘new normal’, with social distancing continuing until a vaccine is available –and no one knows when that will be.

Short term, many have retained staff but have either asked them to work from home or have reduced their hours. Some have been forced to reduce staff numbers to keep the company afloat. Agencies and Rights Holders are being pro-active with around 70% of these groups saying that they are working with clients to ensure that they are still benefiting from partnership – just in a different way.

Another key word is flexibility; no company will survive by keeping to the same rules as before lockdown. Rights Holders, Brands and Agencies, etc will all need to be flexible to weather the storm, with just over 70% of brands saying they were negotiating an extension of rights and just under half of brands were looking at additional assets. Flexible working will be more widely adopted by companies, with the lack of social distancing in cities during commuting one reason why this may continue for longer than we expect.

The move to a digital world has happened quicker due to the Coronavirus

When asked what trends would define the way in which the sponsorship industry will recover over the next decade, nearly one in five said that digital was key with many embracing digital technology unable to leave their homes and be part of events, social activities, etc backed up by 70% of our respondents said that a key change in consumer behaviour would be a greater consumption of digital content.

We have all seen the rise in webinars, ESA included. We set up its first webinar during the first week of the UK lockdown and had over 300 attendees from across the globe listen in to our 2020 sponsorship trends session. Rights Holders and teams are engaging with fans by giving them an insight into players/ athletes lives amidst lockdown, and this type of engagement with fans is key to ensuring that once lockdown is over, the rights holder/team/ brand is remembered fondly by fans.

Another key trend identified by those in the sponsorship industry was the rise in esports. With more people at home, playing and watching of esports has increased. The Guardian described esports as riding the crest of a wave with figures rising during the COVID-19 crisis and it’s not just typical games such as League of Legends, DOTA, etc seeing a rise in following/ participation, but the likes of Formula 1, Darts and Tennis who have all turned to digital gaming to keep fans engaged with the sport during lockdown.

Many companies have made big changes to stay afloat in these difficult times

The impact of COVID-19 on the sponsorship industry has been enormous, of those that responded, over 90% said they expected to see a reduction in business revenue of around 40% in 2020.

Two out of five respondents have had to furlough staff since the start of lockdown, with this figure highest amongst agencies in the absence of events/ hospitality taking place. Of those companies that have had to go down this route, the average percentage of staff on furlough was around 40%. With a just over a third saying their company plans to/may have to apply for government help/ support, this may sadly mean a rise in the number of furloughed staff over the next month.

Brands are seeking alternative ways to continue their sponsorship deals

With the sudden loss of events and some planned activations/ campaigns, brands have had to ‘think outside the box’ and look at alternative ways to make the most out of their sponsorship deals. Some have discussed an extension of rights with their rights holders (72%), whilst others are in discussion around additional assets (48%). Positively only 12% of brands were only considering compensation for events not happening, with the majority looking at various options.

Many brands have ventured down the digital channel, perhaps one of the few ways in which they can still engage with fans – and that’s what is key during this time, engage with fans, keep the brand in the forefront of their minds, so that when lockdown is over, fans will remember the good that the brands have done during that crazy time when we weren’t allowed to leave the house. The recent report from Activative (COVID-19: A Sports marketer’s Guide) demonstrates some examples of the good work that going on despite COVID-19.

The sponsorship industry will recover

When asked about the effect of COVID-19 on the sponsorship industry, 43% felt that this would not have a major negative impact on the industry in the long term. However, it will take time for the industry to recover, with around two thirds thinking it would take 12 months for this to happen.

Nearly two thirds of respondents have made a plan for lockdown continuing for the next three months or longer, with just under half (49%) saying they were preparing for when the lockdown and social distancing has been relaxed. Some brands believe that there will be a higher appetite for live events, with people desperate to get out and about once lockdown is eased. It will be interesting to see the change (if any) in results in Wave 2 of our Sponsorship Sentiment Tracker.

When asked if they plan to adapt their sponsorship approach to anticipate changes in consumer behaviour, it was encouraging to see that an increase in creativity was mentioned by some in the sponsorship industry.

New sponsorships are still taking place, Umbro becoming England Rugby’s kit supplier for the next four years, Rights Holders are continuing to engage with their fans through digital channels, Agencies are using this time to strategise and plan for the future, so that they will be in the best place when lockdown is over. The sponsorship industry will recover.