Every year ESA asks its members what they think the top three trends will be for the year ahead. Back at the beginning of 2020, at the turn of a new decade, we asked members what the trends would be to ensure continued growth for the decade ahead.

However, with the pandemic hitting in March, we knew that those trends were likely to have changed and so we asked our members what key trends would define the way in which the sponsorship industry would recover.

We asked the same question in October and will repeat it again in January 2021, to track how these critical factors changed as we reacted to the evolving pandemic situation.

Let’s have a look at how the top ten trends changed as the year went on.

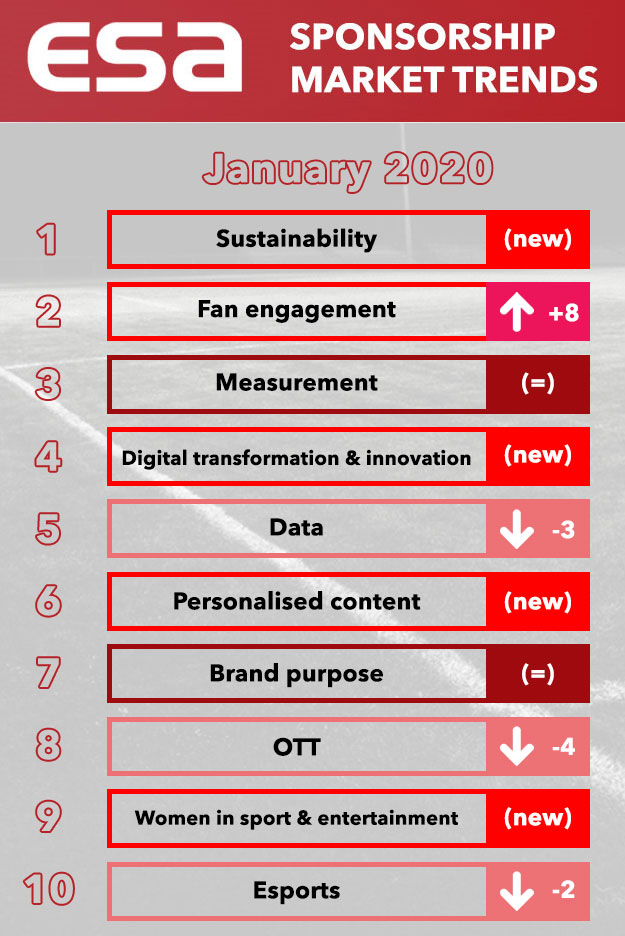

In January, you can see that Sustainability entered the list for the first time and went straight in at number 1. Fan engagement moved up in importance and Measurement maintained its position in the top three from the previous year.

Digital transformation & innovation, personalised content and women in sport & entertainment, were all new entries set to define how the industry would grow in the coming years. Data moved down in importance, as did OTT and eSports, but Brand Purpose maintained its position.

Digital transformation & innovation, personalised content and women in sport & entertainment, were all new entries set to define how the industry would grow in the coming years. Data moved down in importance, as did OTT and eSports, but Brand Purpose maintained its position.

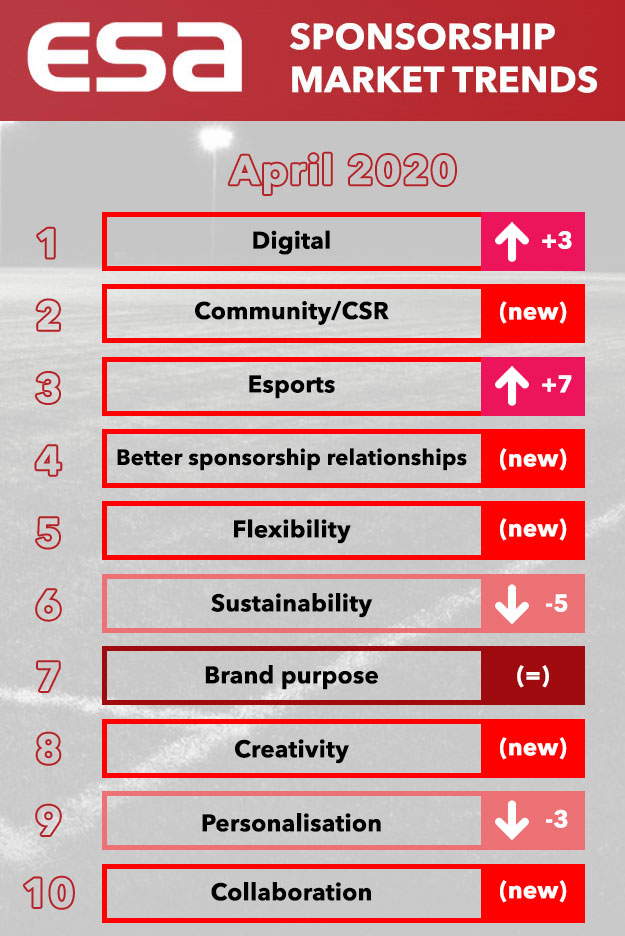

If we now compare April’s data to January, we can see the remarkable changes that happened in the industry’s initial reaction to the pandemic and the lockdown.

Both Digital and eSports rose sharply from positions 4 and 10 respectively, to now both being in the top 3 factors. This was inevitable really as audiences stayed at home and the only way to reach them was online. Organisations who didn’t already have digital platforms had to work quickly to build them. Others who had platforms, but used them primarily for community engagement, now found them to be their main activation channel and the only way to be able to continue delivering sponsors’ rights.

This is a switch that many will rely on until their events can return with audiences attending and for some the increased use of digital will become permanent. The digital transformation that we saw at position 4 at the start of the year, and that wasn’t even in the top 10 in 2019, was now supercharged through necessity into top place.

Another trend borne through necessity is Community/CSR which re-entered the top 10 having been the No. 1 top trend in 2019 but not appearing at all in the first report of 2020. As individuals, we perhaps felt more connected to our community, looking out for each other, and as organisations, we understood our role in helping the community. Whether that was simply reinforcing health and safety guidance or reaching out to those most vulnerable to deliver essentials and provide a welcome face (at distance) to those most isolated.

On the other hand, we saw some amazing innovation with companies pivoting their business to help the pandemic, producing hand sanitiser instead of beer, face masks instead of coats or mouthguards, and ventilators instead of engines. We all had to adapt and, whilst the need for community support might have lessened as we moved out of that immediate emergency state, the lessons we learnt during it will stay with us.

Better sponsorship relationships came straight into the top ten list at number 4. Many sponsorship relationships will have been strengthened as a result of needing to work better together, being more empathetic of the other party’s situation and seeing the opportunity to collaborate on meeting the needs of the shared audience.

But many sponsorships will have also had critical flaws in the relationship brought to the surface and conversations around honouring agreements that were tense. It’s also not over yet, uncertainty remains over when many events will return, under what circumstances and with what sponsorship rights being delivered. Relationships are critically important for managing that uncertainty to achieve the best possible outcomes for both parties.

Flexibility followed after at number 5 and is linked to better relationships as this referred to flexibility in delivering sponsorship. Here we can also reference the first wave of the ESA Sponsorship Sentiment Tracker where 72% of brands were looking to extend sponsorship rights and 48% planning to add new assets to fulfil sponsorship contracts. Both of these required flexibility from rights holders and it appears that simply extending sponsorship contracts for another 12 months has been a common solution.

Sustainability, which was the top trend at the start of 2020 only fell to 6th place and Purpose maintained its position at 7. All of this was reassuring for companies who were positioned for these longer-term trends pre-COVID, that they were still relevant even when immediate priorities changed. The pandemic required all companies to stop and reflect on what their true purpose is and, whilst sustainability might have taken a more ‘survival’ based definition for the short-term, there is an opportunity to reset and ensure we can operate in a truly sustainable way for the long-term.

Creativity, Personalisation and Collaboration made up the rest of the Top 10 in April. Personalisation was higher at the beginning of the year at No.6 but Creativity and Collaboration entered for the first time. Collaboration is aligned with better relationships but also indicates new collaborations.

And finally, creativity will certainly be paramount when faced with so much content being distributed through a concentration of channels and, when more events return, we will quickly reach a saturation point. Creativity will be the key to stand out from the clutter of content.

So, let’s see how those trends changed in October, as we understood more about the pandemic and how long recovery might take.

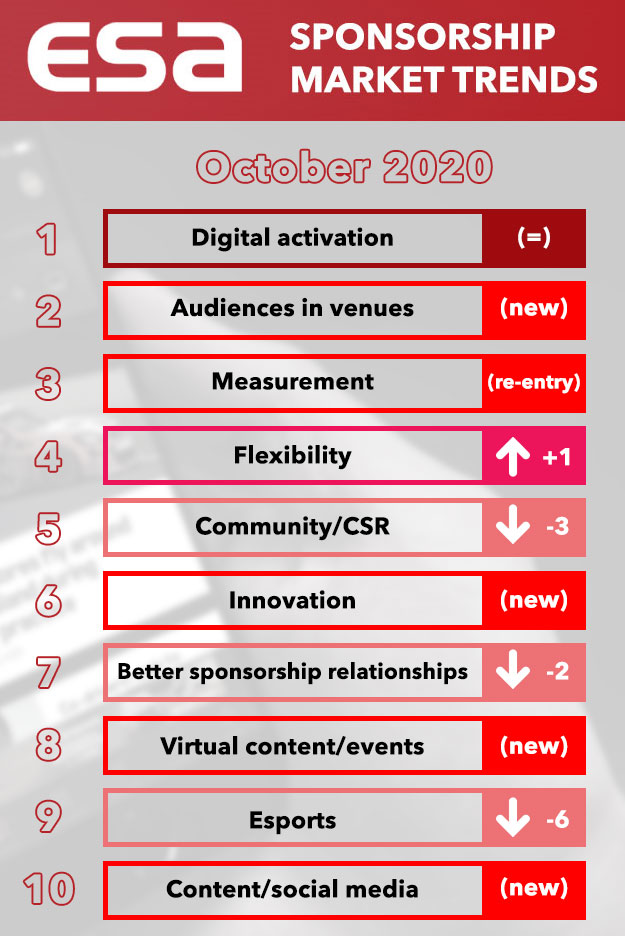

Digital activation remains firmly at the top and we have specified activation here as encompassing digital assets and content but not the digital transformation and infrastructure aspect that we saw back in January.

Audiences back in venues, sounds obvious but when we asked this question in April there was perhaps the perception that the lockdown might only last a couple of months. The situation now of when audiences can come back into venues and when they will want to is very uncertain. That then increases the uncertainty for rights holders, venues and sponsors, particularly if agreements need to be renewed but we can’t say for sure on what basis they will be able to be delivered.

Measurement is very interesting returning back to no. 3, as if this dropped from the priorities in the short-term reaction but is now very much back on the agenda in proving sponsorship’s effectiveness when budgets will be under more scrutiny than ever.

Flexibility has crept up as Community & CSR (which now include Sustainability and Purpose) has moved down, but still quite remarkable to be in the top 10 and at no 5, which shows its importance in the face of some extremely difficult market and business conditions.

Innovation is another trend that disappeared in April. It has come back in slightly lower than it was in January, but we have seen a lot of innovative initiatives in new collaborations and content as companies have had to adapt and build new platforms in order to still deliver to their audiences

Better sponsorship relationships still in the top ten but down 3 places after those initial moments of truth happened when things really counted. It’s pleasing that this is seen as a longer term trend as rights holders in particular need to look to sponsorship for revenue that has perhaps been lost through ticket sales and broadcast.

Virtual experiences and events had not made it onto the list in April but have gained importance now as we look to replace events that are cancelled or delayed for more than just the few months perhaps first thought.

eSports still on the list but a big drop since April. That could be because rights holders are expecting their sport to return soon and perhaps can’t resource both. Or it is seen as an alternative but not a replacement. We don’t really have enough data to speculate on the actual reason and so it will be interesting to see where this one lands when we repeat the annual trends survey early in the New Year.

Finally, Content/Social Media has come in as a few of others – creativity and personalisation – have dropped out.

Sophie Morris is an ESA Board Director and Strategic Marketing & Sponsorship Director at Millharbour Marketing